Is It Time to Refinance My Mortgage?

On May 15th mortgage interest rates hit their lowest level in modern history. With interest rates plummeting, many folks are asking themselves, “Is It Time to Refinance My Mortgage?” Since rates are unlikely to go much lower, if you were considering refinancing, this is probably the time. This simple step can significantly reduce monthly mortgage payments and give needed financial breathing room. However, low interest rates are not the only reason to consider refinancing. Perhaps your credit history has improved since you purchased your home. An improved credit score alone can significantly reduce monthly payments. When combined with lower rates, it’s a homerun. When you initially purchased your home, maybe you didn’t have the down payment and are paying for private mortgage insurance (PMI). If the equity in your home has built up over time, you can significantly reduce your monthly payment by refinancing and getting rid of the PMI.

There’s no such thing as a free lunch!

Unfortunately, refinancing a mortgage comes at a cost. These “closing costs” include things like: Loan application fee, home appraisal, credit report fee, title search and of course the settlement fee (read: the real-estate attorney fee). Lets not forget the “points”.

You pay “points,” which are a % of the loan amount to the lender for a reduced interest rate. For example, if you pay $1,000 in points on a $100,000 mortgage (1%), this could reduce your interest rate by 0.25%. Think of points as interest paid up front. The more “points” you pay, the more money you save in the long run. Of course this assumes providing you have the cash and you plan on living in your house a long time. How long? It depends. The best place to start is a mortgage refinance calculator. These calculators can look at your current mortgage, the closing fees and points and determine if a refinance makes sense. There are a lot of them on-line, but this is one that I use. Here is another good calculator . Its simple to use and wont cause your screen to fill up with spam advertisements.

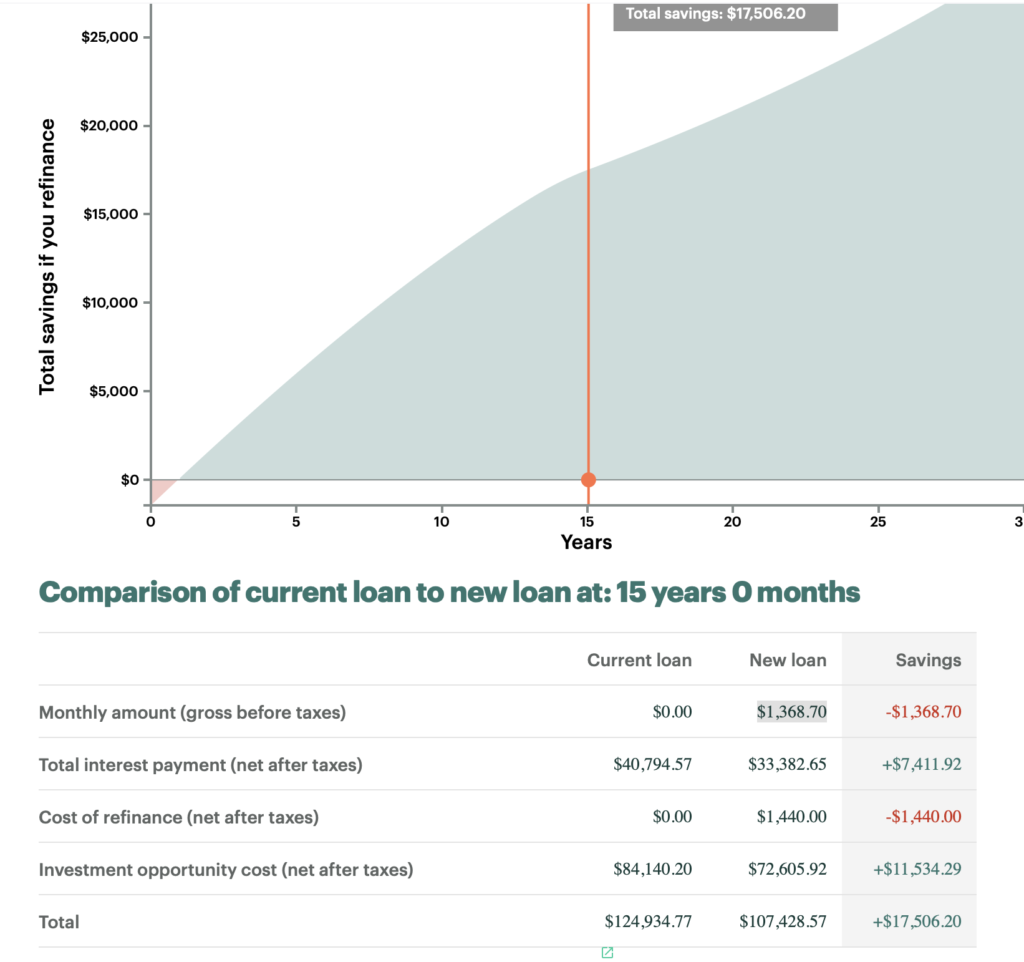

Mortgage Refinance example:

Lets look at a $200,000 mortgage on a $400,000 house. The refinance will be 0 points, $1,500 in closing costs and on interest rate of 2.87%. In just 11 months the refinance will pay for its self as the monthly payments drop from 1,700 to $1,368.70. Over the life of the 15-year mortgage you can save over $17,000.

What about “no points” and / or “no closing fee” mortgages? Well, they are kind of like Unicorns; they don’t really exist. You may see a bank offering such loans, but in reality they are probably charging a higher interest rate to make up for it. For example, I did a search this morning for a 15 year fixed rate mortgage on a $400,000 home with a $200,000 mortgage. One bank was offering an interest rate of 2.875% with $1,500 in closing fees while the next was offering a no-closing fee mortgage at 3.25%. One way or another they will get their money. A no-closing fee / no points mortgage probably makes sense if you are planning to live in your home for just a few years. Otherwise, you are may be better off with the lower interest rate that comes with the fees.

What about a cash-out mortgage refinance?

What about refinancing as a source of cash? Let’s say you have a 400K hours and $200k mortgage and $200k of equity. When you refinance, you could ask the bank for some of your equity back. So you could go from having a $200k mortgage at 4% interest to a $225k mortgage at 3% interest with $25K of cash in your pocket. Should you do it? It depends on what you plan on doing with the money. If the idea is to invest in the stock market with the hope of making money in the coming economic recovery – I advise against it. I’ve already explained my philosophy on investing in bear markets. If the goal is a major purchase like a new car, again I advise against it. You are exchanging real equity for an asset that will do nothing but lose value.

The only thing I would ever advising using equity in your home would be for a major renovation project. Even then, understand you will never make your money back when you sell. If you plan on living in your home a long time and are dying for a new kitchen, then do it. But realize that if you try to sell your house next year, you probably will recoup less than 75% of your investment. Bathroom blues got you down? Go ahead and install that 6’x6’ rain shower. Just realize that you can expect less than a 60% return on your investment when you sell next year. And as years pass, you’ll recoup less and less each year. One last thing – banks typically charge higher interest rates on cash-out refinancing. Those 2.8% mortgages you see advertised? You probably will not qualify if you are getting a cash-out refinance.

There’s never been a better time to refinance mortgages. In these uncertain economic times it pays to consider options that can decrease monthly expenses a few hundred dollars a month.