Financial Advisors – Who Can We Trust

It’s not easy knowing who a veterinarian can trust for financial advice. If you aren’t leery of the people who try to give you financial advice, you haven’t seen The Wolf of Wall Street. Think that was an exaggeration? Maybe this is something that happened once and not likely to be repeated? Think again.

American retirees lose out to corporate greed

In 2016 the Obama administration, through the Department of Labor, proposed a simple rule change. The rule stated that when advising individuals regarding their retirement savings, advisors had to act as a fiduciary. Meaning that they had a legal obligation to put their clients best interest ahead of their own compensation. The rule change, which would have brought the US in-line with other developed counties. It was estimated that American investors would save $17 billion a year from unscrupulous investment advice. This enraged numerous groups whose members directly benefit from these questionable investments. Thanks to legal action brought them and the Fifth Circuit Court this rule is now dead. What does this mean for us? Essentially, its buyer beware.

You will read on some blogs that advice from financial advisors is to be shunned at all cost! That DVMs need to be experts in all areas of personal finance! That’s not really practical. Even though I have an MBA and several years experience, in reality I’m a veterinarian not a financial analyst. There are times when outside advice is not only necessary, its preferred. Nevertheless, it’s hard to know who to trust.

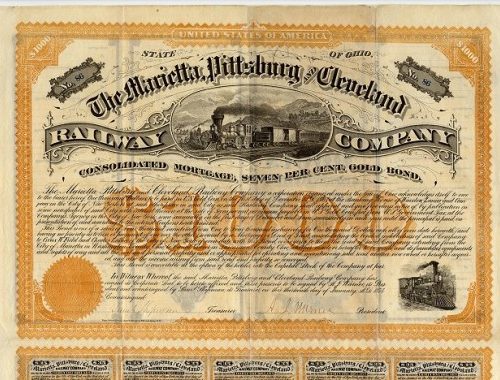

Stock brokers

The first group to immediately dispatch is stock brokers. First of all, their entire purpose in life is to take money out of our pocket and put it in theirs. They fall into a category of financial advisors called “commission only.” Their make all their money on commissions paid to them when you buy and sell investments, so it’s always in their best interest to steer you to the investment that pays them, not you, the highest return. To assume they know anything about when the stock market or even an individual stock is going to up down or sideways is ludicrous. Most have little more than an undergraduate degree and very little special training except in sales tactics.

For reasons we already discussed, most individual investors should not be purchasing individual stocks anyway. The type of diversification needed to protect and grow one’s nest egg can be best achieved through a portfolio of no-load, low cost, index mutual funds. You don’t need a stock broker to purchase these so suffice it to say just say, if they come calling – hang up!

Financial Planners

Fee only advisors

This group is more diverse and can be best sum with the cliché: the good the bad and the ugly. The good guys are the ones that are “fee only” financial planners. These planner work exclusively for a fee – paid for by the client. These folks do not accept any compensation when their clients purchase a financial product so there is no potential conflict of interest. They have a fiduciary (legal) responsibility to put the needs of their clients first. If a potential conflict were to arise – they must report this to their client. If you need financial advice, these are the folks you want to seek out. Because they receive no outside compensation, they may be more expensive, but bias free advice is worth it. The largest organization representing these planners is the NAPFA.

Fee based – the bad boys

This has led to an invasion of ugly look alikes called “Fee Based.” These bad boys (and girls) charge their clients for advising them and get compensation for selling financial products. Thus they have an inherent conflict of interest to steer you to the product that benefits them the most. In fact, these advisors work under a standard that requires that their recommendations only be suitable to your particular situation. They do not have to recommend the best for your situation.

These folks call themselves “fee based” at least partially to confuse you; however, make no mistake these advisors are not the same as “fee only” planners. Because of the potential conflict of interest caused by the receipt of monies from the sellers of financial products, and the fact that the client is actually paying for potentially unscrupulous investment advice I never recommend these advisors for veterinarians or anyone else for that matter. Yet some of the largest names in the financial world fall into this category. Do your homework. Sometimes this information is hidden on their webpage.

It’s a jungle out there for the DVM investor! The best defense is a solid education. For times when outside help is needed I would stick with “fee only” financial planners. Next we will try to digest the alphabet soup of financial certifications.

One Comment

Pingback: