2021 Financial Check-Up pt. Deux

In the first installment of the 2021 financial check-up, we covered the importance of having an emergency fund and home savings account. This is important stuff, but here is an even bigger question: how are your retirement savings going?

2021 Financial Check-Up

One of the biggest questions that come up when I speak to collogues about money is: how much should I be saving for retirement? Although that sounds like a reasonable question, what we really should be asking is “How much will I spend in retirement.” Until we know how much we will spend later, there is no way to know how much to save now. A lot financial advisors believe we will spend less in retirement than we do currently. An often-quoted figure is that you will need 70% of your current take home pay. The argument goes that since you won’t have children in school, your house will be paid off, and you won’t be buying scrubs, you’ll be saving a lot of money. That’s nonsense.

Why we spend more in retirement

While employed, we spend most of our week tied to our clinics. Other than the morning Starbucks or the occasional lunch time sandwich run, there’s little opportunity for real spending. Come the weekend, and we are ready to do financial damage! We eat at restaurants (ok, not in 2020), visit the mall (most years), shop online. It adds up quickly! Now imagine every day is a weekend! How much will you need to finance 365 days of vacation?

365 days of Saturdays

Researchers at the Wall Street Journal asked the same question. In a recent study, groups of participants were asked questions about what exactly they wanted to do in retirement. Questions focused on 7 specific areas: eating out, digital services, recharge, travel, entertainment & shopping, and basic needs. The folks running the study attached real world costs to these retirement scenarios and discovered that the average person would need to make 130% of their current income to live the lifestyle they wanted. Thats why retirement savings is such an important part of this Financial Check-Up.

How much do I need to have saved?

Let’s say for a moment that we make $100k a year and we would be content with that income in retirement. The real question is how much should we have saved to finance this $100k lifestyle? Here is where it gets complicated. One rule of thumb suggests that we can safely spend 4% of our retirement nest egg every year and never run out. Assuming that social security provides us with 36K a year, then we need $1.6 million ( $64,000 /0.4) saved before we retire. Sounds like a lot, but its achievable!

Others have suggested that we need to have saved 12 times our desired annual retirement income. Thus, to live a $100k lifestyle we need to have saved 1.2 million. That’s still a lot, but less than $1.6 million. Which is right? The truth probably lies somewhere between. Of course, these are just rules of thumb, but you’ll probably want to have saved at least $1.2 – $1.6 million saved for retirement. One thing we haven’t even begun to consider is how much we need to save to reach these goals. It’s attainable, it just takes commitment to saving and some smart planning. It’s a topic we will cover again soon.

One final rule of thumb

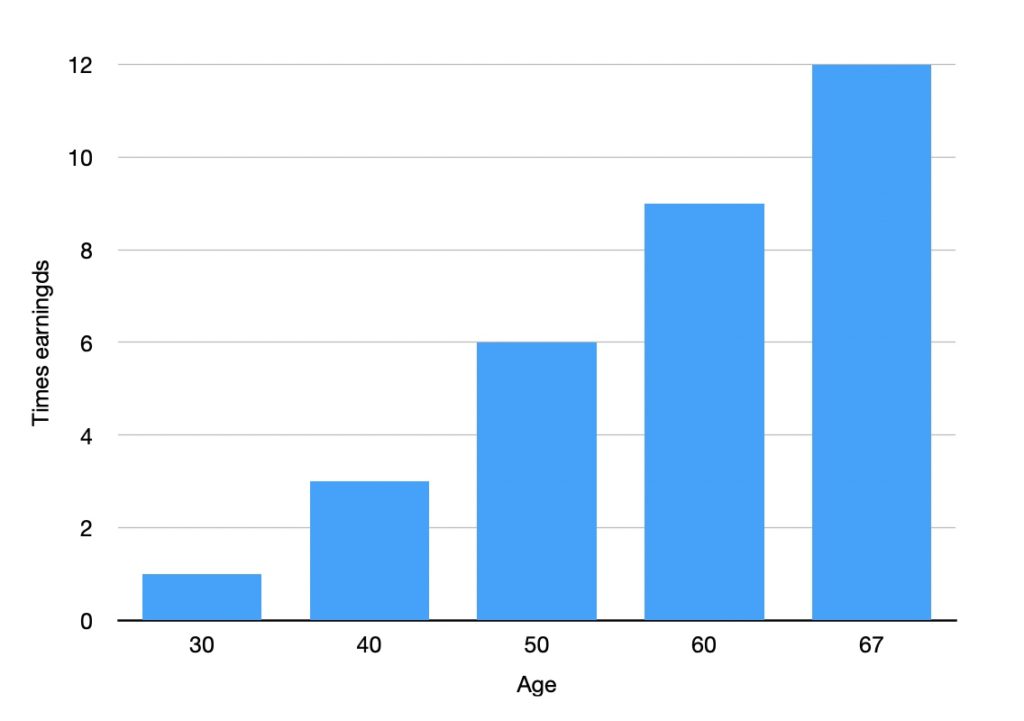

I’ll end this 2021 Financial Check-Up part Deux with one final rule of thumb. It’s a benchmark of sorts. It shows at each major decade of life how much in relation to our current salary we should have saved.

How’s your retirement savings going?