Why Are Otherwise Smart Vets Turning Down Free Money?

Its crazy. I have a friend who works in a small multi-doctor practice in Pheonix. Their clinic offers a SIMPLE IRA for employees. When you hear “Simple IRAs” (Savings Incentive Match Plan for Employees of Small Employers) think “401K for small business”. Essentially their employer will match every dollar deposited into the account up to 3% of their salary. It’s like getting free money! And yet other than possibly the practice owner and this one veterinarian, none of the other doctors or technicians seem interested in participating. We have a building full of really smart highly trained people that are literally saying 1) no thanks to free money and 2) I have absolutely no plan for retirement.

What is a “SIMPLE IRA”?

A SIMPLE IRA is an easy to set up, easy to administer retirement plan for small businesses (less than 100 employees). Essentially, younger employees can make tax deductible contributes up to $13,000 a year ($13,500 in 2020) and those over 55 can deposit up to $16,000. The employer either matches what the employee deposits into the plan – up to 3% of his/ her salary – or can elect make contributions for all employees at a flat rate of 2% of salary. In the interest of encouraging savings and minimizing expenses most employer elect the former. So if you don’t deposit money into the IRA you don’t get anything from your employer.

Why would a vet practice offer a SIMPLE IRA ?

What’s in it for the employer? Well for starters it a great recruitment instrument. In my personal finance class, I tell my students that a matching retirement plan is something they need to look for when job hunting. Secondly, the amount deposited into the employee’s accounts is tax deductible for the employer. So the government is really pays part of the matching expense. Lastly, the boss gets to participate. Since his/her salary is likely to be higher than everyone else, they will benefit most.

Why SIMPLE IRAs make a big difference

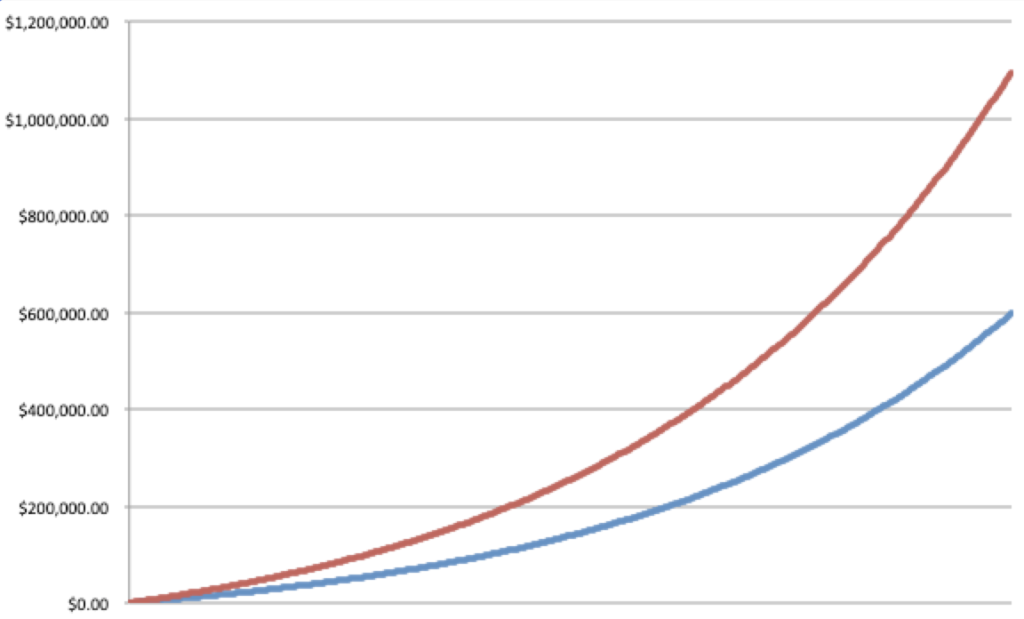

Nancy is a veterinarian in a small animal practice making $100,000 a year. The practice offers a SIMPLE IRA and she contributes $300 a month into her account. Over the course of her career, she earns a respectable 6% return on her investments. If there was no matching component to her plan, when she retired in 40 years her IRA would have $597,000 (blue line). Not an insignificant amount; however, because SIMPLE IRA accounts have a 3% matching, an additional $250 a month is going into her account! Nancy saved a total of $144,000 and her employer deposited $120,000 over a 40 year career. That $264,000 – $550/ month – blossoms into over 1 million dollars (red line) at retirement!

Now that’s a nest egg to be proud of! What if in 10 years Nancy decides to work for a different practice? If she changes employers, funds in a SIMPLE IRA can be rolled over into another SIMPLE IRA, another employer-sponsored plan (e.g. 401k) or a traditional IRA.

The point is simple. If your employer doesn’t offer a matching retirement plan (SIMPLE IRA, 401K, etc.) – find one that does. Even the smallest of practices can offer them. If a practice doesn’t value your future, you shouldn’t be working for them. If you practice does offer a plan – use it! If you don’t you are literally saying no thanks to free money and a comfortable retirement!

One Comment

Pingback: