Retirement savings and time

There are so many unknowns when it comes to saving for retirement. Will social security still be around? Probably. How much will I need to live on? More than you think. How much will my investments earn? Not as much as your parents. Really, the only thing we know for sure is that when it comes to retirement, savings and time are the two most important factors. Its jus never too early to start saving. Let’s explore this further with two recent graduates: Sara and Steve.

Retirement savings and time example

Sara is working in a small animal practice. Her employer offers a SIMPLE IRA (think 401k for small business) with 3% matching. Contrary to popular belief, these plans are not uncommon. Essentially her employer will match anything she saves for retirement up to 3% of her salary. So if she makes $100,000/ year they will match what she puts into her IRA up to $3,000 or $250/month. It’s a bonus Sara earns by simply investing in her future.

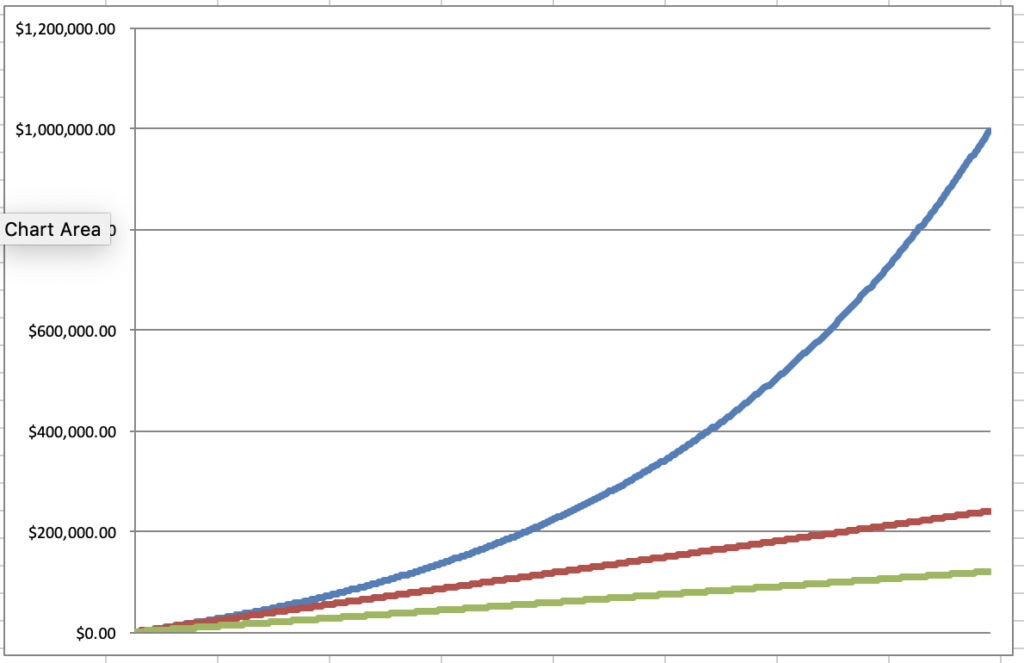

Sara is thinking of saving $250 a month in her SIMPLE IRA. If she does, her employer will match the $250. When Sara turns 65, assuming she earns a reasonable 6% return, she will have ~1million dollars saved for retirement. Not all the money in the world, but she won’t be eating cat food either! By investing a total of $120,000 of her money and $120,000 of her employer’s money, she earned $760,000,

- Green line – Sara’s contribution

- Red line – Sara & employer’s contribution

- Blue line – Value of Sara’s IRA

Don’t forget taxes!

As an added bonus, Sara can claim the $250/month as a tax deduction. Therefore, it actually costs her far less. How much less? Assuming that Sara is in the 24% federal tax bracket, her monthly taxes are reduced by $60 ($720 a year). Sara’s $250 a month investment in her future, really costs her just $190.

Retirement savings and time example #2

Let’s look at her associate Steve. Steve, also recently graduated and has decided that it’s crazy to be thinking about retirement at age 25. Besides, he can use the $250 a month to pay for things that he really needs – like new skies! If Steve waits until he is 35 to start saving, and he puts the same $250 a month away, his haul at retirement will only be about 1/2 of Sara. How can this be? It’s all in the compounding.

What is compound interest?

Perhaps it’s best described as interest earned on interest. What do I mean? let’s look at an example of simple interest. Say you have $10,000 invested and it is earring 6% per year. In this example we assume that you take the earnings immediately out of the account. It would look something like this:

Year Investment Earnings

- Year 1 $10,000 $600

- Year 2 $10,000 $600

- Year 3 $10,000 $600

- Year 4 $10,000 $600

At the end of 4 years you would have your original $10,000 and earned $2,400 for a total of $12,400. Now let’s assume you leave all the earnings in the account. It would look like this:

Year Investment Earnings

- Year 1 $10,000 $616

- Year 2 $10,616 $654

- Year 3 $11,270 $695

- Year 4 $11,965 $714

At the end of 4 years you would have a total of $12,702. The longer you invest, the greater the divergence between simple and compounded interest. Thats why its important to start investing early! Just look at the graph of Sara’s savings above. Notice how increase in the Blue line’s slope accelerates as we progress along the time line. This is due to the effect of interest being earned on interest.

Playing catchup…

Suppose the older and wiser 35 year old Steve has decided to try to catch up so that his savings equals Sara’s. How much will he need to invest? Well to end up with a million dollars after 30 years assuming 6% return on investment would require a $1,000 month investment. But remember his employer only matches up to 3% of income. If Steve is making 100,000 a year, they will only contribute about $250 a month towards his retirement. Steve will end up having to invest $750 a month.

Thats $270k that Steve ends up putting toward retirement. Remember that Sara only had to put $120k of her money towards retirement. It will cost Sara less than 1/2 of what it will cost the 35 year old Steve. And what if Steve waits until he is 45? He will need to invest $2,164 / month or $519K to end up at the same place as Sara when she retires.

Be a Sara not a Steve

When planning for retirement, nothing is more precious than time. Be Sara, not Steve. If you aren’t putting money away, start today. If you are, its time to consider saving more.